How to Make Profit on Various Investments

Investing can be a daunting task, but with the right strategies and knowledge, anyone can learn how to make profit on their investments. Whether you’re a beginner or a seasoned investor, understanding the fundamentals of various investment types is crucial. In this article, we will explore several avenues to profit, including stocks, real estate, cryptocurrencies, and more. For more insights, visit how to make profit on primexbt primexbtinvest.com.

Understanding the Basics of Investment

Before diving into specific investment types, it’s important to understand the basics of how investments work. At its core, investing involves allocating resources, usually money, to generate income or profit. The key to successful investing is to identify opportunities that align with your financial goals and risk tolerance.

The Stock Market

The stock market is one of the most popular investment avenues for individuals looking to make a profit. By purchasing shares of a company, investors essentially buy a small portion of that company. The value of these shares can increase based on the company’s performance, and successful investors often look for undervalued stocks to maximize their returns.

To make profit on stocks, consider the following strategies:

- Research and Analysis: Conduct thorough research on companies, industries, and market trends.

- Diversification: Spread your investments across various sectors to minimize risk.

- Long-Term Investment: Consider holding stocks for the long term to ride out market volatility.

Real Estate Investing

Real estate is another promising investment opportunity. It provides a tangible asset, and its value can appreciate over time. Investors can make profit by renting out properties for passive income or by flipping houses for a quick return.

Here are some strategies for making profit in real estate:

- Buy and Hold: Purchase properties in up-and-coming areas and wait for appreciation.

- Flipping Properties: Buy undervalued properties, renovate them, and sell for a profit.

- Rental Properties: Purchase residential or commercial properties and earn rental income.

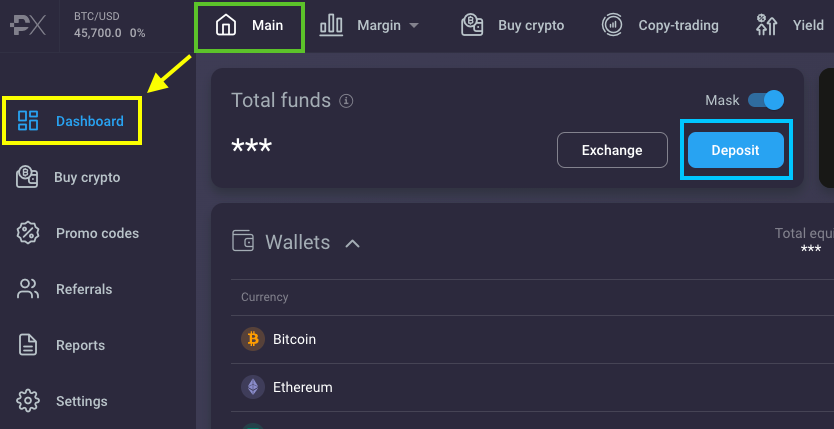

Cryptocurrency Trading

Cryptocurrencies have surged in popularity over the past decade, offering a new avenue for profit. However, this market is highly volatile and requires a good understanding of the underlying technology and market dynamics.

Tips for making profit on cryptocurrencies include:

- Stay Informed: Keep up-to-date with news and developments in the crypto space.

- Diversify Your Portfolio: Invest in various cryptocurrencies rather than putting all your eggs in one basket.

- Understand Market Trends: Analyze price trends and market sentiment to make informed trading decisions.

Forex Trading

Foreign exchange (Forex) trading is the act of buying and selling currencies in pairs with the aim of making a profit. It is one of the largest financial markets globally, and traders can profit from both rising and falling markets.

To successfully trade Forex, consider these strategies:

- Implement a Trading Strategy: Develop and stick to a well-defined trading strategy.

- Utilize Leverage: Use leverage to amplify your profits, but be cautious as it also increases risks.

- Practice Risk Management: Always set stop-loss orders to protect your investments.

Investing in Mutual Funds and ETFs

Mutual funds and exchange-traded funds (ETFs) offer a way to invest in a diversified portfolio without needing to purchase individual stocks. They are managed by professional fund managers, making them ideal for beginner investors.

Tips for investing in mutual funds and ETFs:

- Choose the Right Fund: Look for funds with strong historical performance and low expense ratios.

- Diversify Within Funds: Invest in a mix of funds that focus on different asset classes (stocks, bonds, etc.).

- Invest for the Long Term: Focus on long-term growth potential rather than short-term market fluctuations.

Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms allow individuals to lend money directly to others and earn interest on their loans. This form of investment can yield higher returns than traditional savings accounts or bonds.

To succeed in P2P lending, consider these factors:

- Evaluate Borrower Risk: Carefully assess the creditworthiness of borrowers.

- Spread Your Investment: Lend to multiple borrowers to reduce risk exposure.

- Stay Informed: Keep up with the latest regulations and market trends affecting P2P lending.

Conclusion

Learning how to make profit on investments requires knowledge, research, and a disciplined approach. Whether you choose to invest in stocks, real estate, cryptocurrencies, or other avenues, remember to assess your risk tolerance and financial goals. By implementing the strategies discussed in this article, you will be better equipped to navigate the investment landscape and work towards financial success.